Tesla no longer unrivaled king of EVs, BYD are - Seal’s arrival in Malaysia to propel them further locally?

- KEY TAKEAWAYS

- Government support key in their success

- Tesla went for premium sexy, BYD went for affordability sexy

- Making your own EV components helps

- So, what does this all mean for the automotive industry and the future of transportation?

- Could the Seal’s arrival in Malaysia cement BYD's place as the premier EV distributor locally?

In the dynamic world of electric vehicles (EVs), a significant shift occurred in 2023's fourth quarter, as reported by Forbes. BYD, a company once lesser-known in the global market, surpassed Tesla to become the world's biggest EV seller. With a staggering sale of approximately 530,000 vehicles, BYD outdid Tesla's 485,000, marking a pivotal moment in the EV industry.

KEY TAKEAWAYS

When will the BYD seal be launched in Malaysia?

BYD Malaysia will officially introduce it on 19th Jan 2024How much will it cost?

There's no official pricing, but many are expecting it to start from RM180k

This achievement is not just about numbers; it's a story of strategic innovation, government backing, and a vision that transformed BYD from a battery maker in 1995 to an EV powerhouse. If you prefer to hear and watch on “ How BYD overtook Tesla”, you can watch Bloomberg Original’s video on the matter, but for those who prefer to read, stay on.

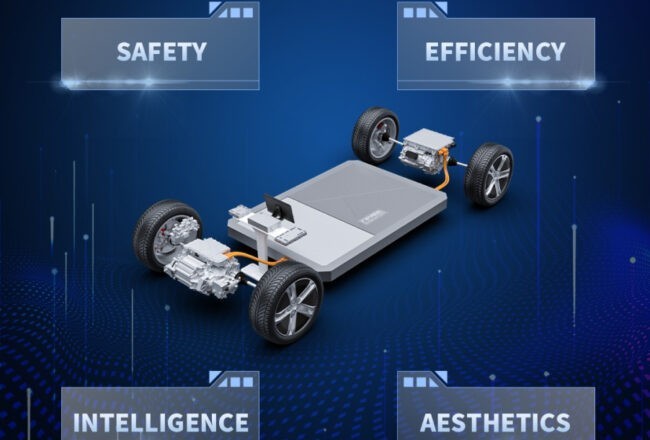

BYD's journey begins in 1995, not as a car manufacturer, but as a battery company. This origin is crucial because it gave BYD an edge in one of the most critical components of EVs: the battery.

Unlike many other carmakers who rely on external suppliers for batteries, BYD could leverage its expertise to develop and produce batteries in-house. This vertical integration is a significant advantage, especially during times like the COVID-19 pandemic when global supply chains were disrupted.

Let's dive into the three key factors that catapulted BYD to the forefront of the EV market:

Government support key in their success

The Chinese government played a massive role in the rise of BYD. Imagine a scenario where the government doesn't just support an industry but actively nurtures it with financial incentives, tax exemptions, and policy support.

China did this for its EV industry, investing billions into it. This support wasn't just financial; it also included setting mandatory EV production targets for automakers and offering them perks like cheaper loans and R&D subsidies. BYD, being a local Chinese manufacturer, benefitted enormously from this.

Tesla went for premium sexy, BYD went for affordability sexy

While Tesla went for the high-end, 'make electric cars sexy' approach, BYD took a different path. They focused on making EVs affordable. BYD's lineup includes models starting at prices much lower than Tesla's cheapest offering, making EVs accessible to a broader market. They also concentrated on producing a large volume of cheaper models, which is quite a contrast to Tesla's strategy.

Making your own EV components helps

BYD makes a significant percentage of its car components in-house, including about 75% of the parts that go into its flagship model, the Seal.

This level of vertical integration is uncommon in the industry and allows BYD to control its costs and supply chain more effectively. The fact that BYD manufactures all its batteries internally is a huge advantage, especially given the global battery supply constraints.

So, what does this all mean for the automotive industry and the future of transportation?

BYD's rise signifies a shift in the EV market. It's not just about luxury or performance anymore; it's about accessibility and practicality. BYD's approach caters to a broader audience, making EVs an option for the average consumer, not just a luxury item for the wealthy. This democratization of EVs could accelerate the global shift to cleaner transportation.

Moreover, BYD's story reflects a broader trend in the global automotive industry. To some, the future of cars is electric, and the race is no longer dominated by traditional automakers or even Tesla. New players, especially from China, are emerging as serious contenders.

But BYD's journey isn't without challenges. Expanding globally, especially into markets like Europe and the United States, brings its own set of obstacles. BYD needs to navigate different regulatory environments, establish brand recognition, and compete with well-established automakers who are also ramping up their EV offerings.

Moreover, the issue of subsidies raises questions about fair competition, European automakers, for instance, are wary of Chinese EVs entering their market, benefiting from significant subsidies that lowered sales prices. This concern could lead to regulatory pushback or demands for a level playing field.

BYD's founder, Wang Chuanfu, a chemist and engineer, is often contrasted with Tesla's Elon Musk. Wang's low-profile, practical approach to EVs contrasts sharply with Musk's flamboyant, high-end strategy. This difference in leadership style is reflected in their companies' approaches and could shape the future trajectory of the global EV market.

Could the Seal’s arrival in Malaysia cement BYD's place as the premier EV distributor locally?

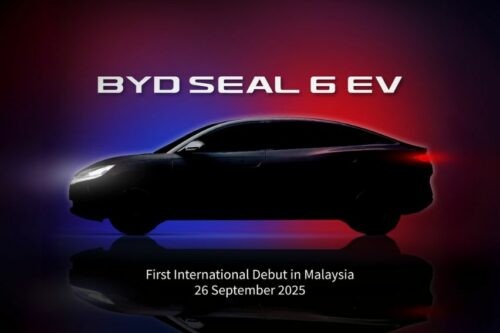

As BYD continues to expand its global presence, the launch of the BYD Seal in Malaysia will mark a significant milestone. Known for its sleek fastback design and often referred to as the "Model 3 killer" in China, the BYD Seal is poised to make a notable entry into the Malaysian market.

With its introduction scheduled for January 19, and an anticipated pricing that undercuts the Tesla Model 3 by a notable margin (starting from RM180k), the Seal's arrival raises a crucial question: Will this launch solidify BYD's position as the premier EV distributor in Malaysia?

BYD or Tesla has not yet posted their 2023 sales record but BYD did get a head start with the Atto 3 SUV and later on the Dolphin hatchback. Tesla only started delivering the Model 3 at the end of 2023, and the Model Y is due for a launch this year. On this basis is safe to say that BYD certainly leads the in the local EV market, and perhaps the Seal's arrival will pull them further away.

This strategic move and pricing could potentially reshape the competitive landscape of the Malaysian EV market, underscoring BYD's commitment to offering innovative and affordable electric vehicles globally.

In conclusion, BYD's ascent in the EV market is a story of strategic foresight, government support, and a keen understanding of market needs. It's a tale that highlights the rapidly changing landscape of the automotive industry and points to a future where EVs are accessible to all.

As the world moves towards cleaner, more sustainable transportation, BYD's journey offers valuable insights into how this transition might unfold and who the key players might be.

BYD Seal Related Stories

- News

- Featured Stories

BYD Car Models

Don't Miss

Malaysia Autoshow

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

BYD Featured Cars

- Latest

- Upcoming

- Popular

Latest BYD Seal Car Videos on Zigwheels

Compare & Recommended

|

|

|

|

|

|

Seating Capacity

5

|

5

|

5

|

5

|

5

|

|

Fuel Type

Electric

|

Petrol

|

Petrol

|

Petrol

|

Petrol

|

|

Power

308

|

162

|

118

|

137

|

137

|

|

Torque

360 Nm

|

213 Nm

|

153 Nm

|

172 Nm

|

172 Nm

|

|

Transmission Type

Automatic

|

Automatic

|

Automatic

|

CVT

|

CVT

|

|

Engine

-

|

1998

|

1496

|

1798

|

1798

|

|

Ground Clearance

-

|

-

|

-

|

-

|

-

|

|

|

Trending Sedan

- Latest

- Upcoming

- Popular